Conventional banks have historically controlled the financial sector. Yet, they have not always been within reach for individuals living in locations lacking physical bank branches. This is where a Neobank, also known as Fintech banks, come into play. These cutting-edge, digital-only financial institutions are revolutionizing the banking landscape. By operating exclusively online, neobanks can provide customers with advantages such as lower fees, quicker loan approvals, and early access to their salaries.

What is a Neobank?

A Neobank is a financial technology (Fintech) provider that operates primarily online, providing services such as checking accounts and debit cards without any physical branches. The terms Neobank, Fintech bank, challenger bank, and digital bank are often used synonymously. Neobanks focus on simplifying the banking experience by offering financial services through a digital-only, customer-focused approach.

By 2027, the global Neobanking market is expected to reach $3.0 trillion in transaction value, up from $2.3 trillion in 2023, according to Statista. As digital financial services become more popular, Neobanks are set to play a major role in the future of banking.

Neobanks vs online banks and digital banks

Neobanks are Fintech's that operate exclusively online without physical branches, focusing on seamless, user-friendly experiences through mobile apps and web platforms. They offer lower fees, quicker services, and innovative features like early salary access and real-time spending insights.

Online banks are traditional banks that have expanded to include online and mobile banking options while maintaining physical branches. This hybrid model offers digital conveniences and in-person services, typically providing a wider range of services like mortgages, personal loans, and investment products. Digital banks encompass both neobanks and online banks, leveraging technology to enhance customer experience and streamline operations.

Neobanks operate exclusively online without physical branches, online banks combine digital services with physical branches, and digital banks encompass both categories.

Neobank vs traditional banking

While Neobanks and traditional banks share many similarities, they remain fundamentally distinct. Let's explore the key differences between Neobanks and traditional banks.

Neobanks operate without physical branches

Unlike conventional banks with numerous branches, neobanks are entirely digital, allowing users to manage accounts through an app. This online-only model reduces operational expenses and eliminates costs associated with physical branches. While traditional banks have expanded digital services, neobanks offer more user-friendly and accessible options.

Neobanks lack regulation

Neobanks are financial institutions that operate without the need for traditional banking licenses, allowing them to bypass certain regulations. This cost-saving enables them to offer enhanced services at reduced prices. Some neobanks may have partial, full, or specialized banking licenses, which allow them to provide a comprehensive array of banking services.

Neobanks are cost-effective

Without physical branches, neobanks reduce expenses, offering no account opening fees, minimal maintenance costs, no minimum balance requirements, no hidden charges, and higher interest rates on savings. They are also more transparent about fees compared to traditional banks, which often have numerous hidden charges.

Neobanks provide greater flexibility

Unlike traditional banks, tasks with neobanks are simpler. Setting up a new account and registering is more straightforward. Obtaining a loan from a neobank is easier, as traditional banks require various checks for credit cards or loans.

Traditional banks offer a broader range of services. Neobanks, known for their speed, user-friendliness, and flexibility, typically focus on one or two core services. In contrast, traditional banks offer a more extensive array of services, largely due to their physical branches. Individuals skeptical of or unfamiliar with digital banking services tend to favor traditional banks.

Traditional banks are more accessible

Neobanks have grown rapidly due to the demand for online banking convenience. Despite this, traditional banks remain more popular because of their accessibility and reliability. Customers value the ability to visit physical branches or speak directly with representatives, services often lacking in neobanks.

| Neobank | Trditional bank | |

|---|---|---|

| Platform | Web and mobile services | Physical banking |

| Market entry | Up to 100 years ago | Up to 10 years ago |

| Client relationships | Longer-term, in-person, with minor changes | Flexible, virtal and easy to modify |

| Customer support | In-person, phone and online | Phone and online e.g. chatbot |

| Fees | Complex and high | Simple, transparent and low |

| Banking licence | Full | None, part or full |

| Banking offices | Yes | No |

| Confirmation process | Lengthy | Instant |

Neobank company examples

Neobanks are revolutionising the banking industry by offering innovative, cost-effective, and customer-centric solutions. Their digital-first approach allows them to quickly adapt to changing consumer needs and regulatory environments, positioning them as formidable competitors to traditional banks. Below are some examples of leading Neobanks across the world.

Starling Bank

Starling Bank, founded in 2014, is a UK-based Neobank offering a free current account with features such as spending insights, savings goals, and fee-free spending abroad. Starling has also ventured into business banking and provides a kids' debit card called Starling Kite. The bank's commitment to innovation and customer satisfaction has helped it rapidly grow its client base.

Varo

Varo is a U.S.-based neobank that offers a range of financial services including checking and savings accounts, early direct deposit, and no monthly fees. Varo aims to provide a more inclusive banking experience by offering tools for budgeting and saving, as well as access to cash advances and personal loans.

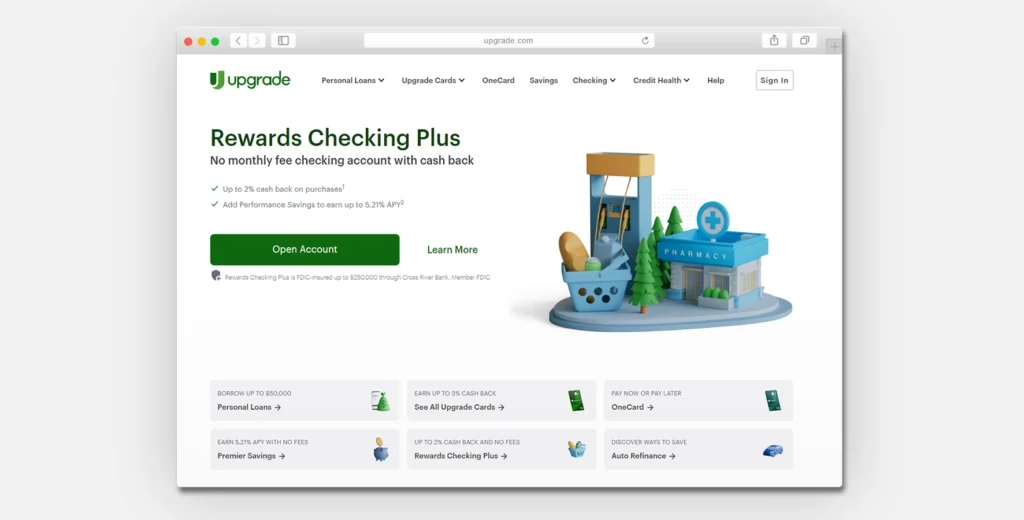

Upgrade

Upgrade is a neobank that combines personal loans, credit cards, and mobile banking services. Upgrade focuses on providing affordable and responsible credit to consumers, along with tools to help manage their finances. The platform offers rewards for responsible credit use and provides free credit monitoring.

Chime

Chime is a U.S.-based neobank that offers fee-free banking services, including early direct deposit, automatic savings, and no overdraft fees. Chime aims to simplify banking for its users by providing a user-friendly mobile app and a network of fee-free ATMs. The bank also offers features like SpotMe, which allows eligible members to overdraft their accounts without incurring fees.

FAQ

Fintech Neobanks are digital-only financial institutions that operate without any physical branches. They leverage technology to offer a range of banking services, often at a lower cost and with greater transparency than traditional banks.

Neobanks eliminate the overhead associated with maintaining physical locations, allowing them to pass on the savings to their customers through reduced fees and enhanced service offerings.

Examples of Neobanks include Current, Chime, and Aspiration. These institutions offer various digital banking services such as early paycheck access, fee-free ATMs, and tools for saving and credit building.

Fintech companies use advanced technologies such as AI-driven fraud detection, biometric authentication, and blockchain to enhance security. These measures help safeguard user data and financial transactions.